Chokepoint Investing

A tango with eagles, dragons, bulls and bears

The geopolitical Three-Body Problem

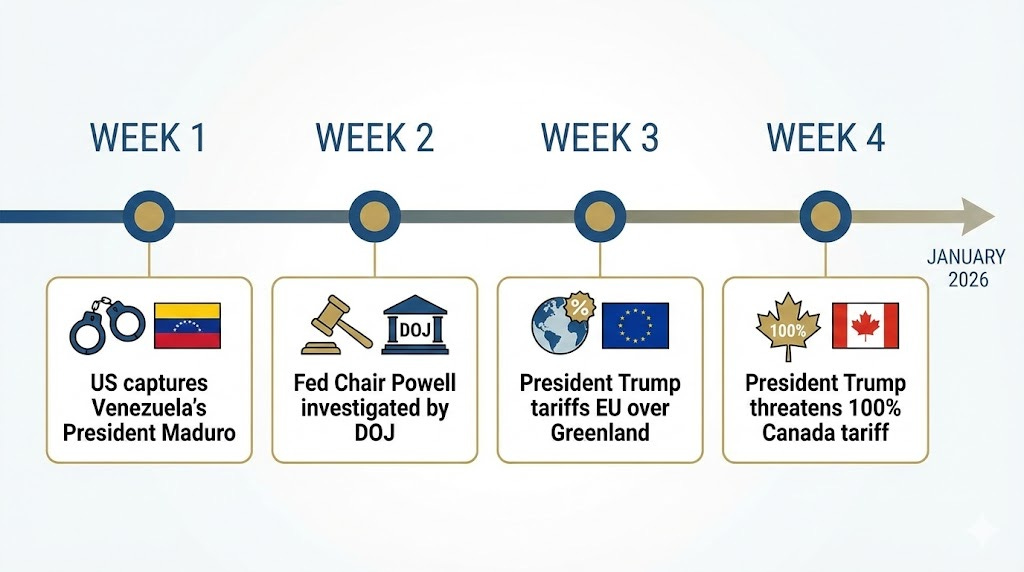

Just as I was about to call 2025 a weird year and be done with it, the headlines in the first few weeks of January have made it clear there’s no reprieve. What’s more interesting is how it’s leaking into real life - friend group chats, family dinners, and my TikTok FYP are all talking about the somewhat bizarre events of recent weeks.

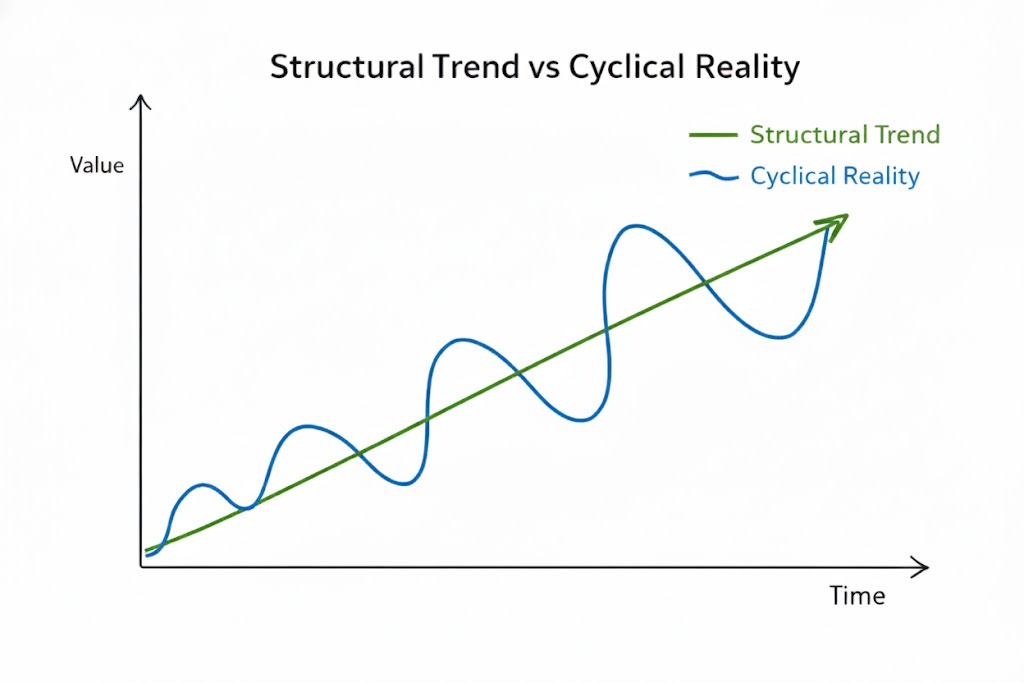

It is almost as if there is a collective realisation that the global order is shifting - that these are not one-off antics but part of a structural re-shuffling of priorities amongst the major powers. The velocity at which these developments unfolded also brings in an odd sense of urgency, and serves as a reminder that policy and market cycles are indeed being compressed - what used to take months of negotiation is now being reduced to hastened unilateral actions and reactions.

Recent geopolitical events have accelerated the transition towards a dynamic multipolar system - a state aptly described by former Singaporean Foreign Minister George Yeo as a geopolitical “Three-Body Problem”. In this new configuration, the gravitational pulls of major poles like the USA, China and Europe create unpredictable orbits for the rest of the world.

While chaotic, the disturbances created by this cosmic tug-of-war will set trends in motion that create fresh investment opportunities.

A dance of eagles, dragons, bulls and bears

I believe that we are in the midst of a global reindustrialisation buildout, driven by a collective shift in priorities from absolute economic efficiency (ie. mutual interdependence, comparative advantage) towards national and economic security (ie. sovereign supply chains, reshoring and friend-shoring).

Against this backdrop, capital no longer flows solely to the most efficient producers, but to strategically aligned producers that resolve supply chain chokepoints for key technologies. This has positive implications on a swath of industrial sectors like AI , defence and energy infrastructure across their entire value chains, which includes their commodity inputs.

These priorities are explicitly codified in the national strategy plans of the major powers, which were just released in the past couple of months. This provides crucial insights on their motivations for their recent actions on the global stage.

The USA

The 2025 National Security Strategy of the USA marks a definitive departure from globalism that characterised US foreign policy for decades. This has given way to an “American First” posture, with focuses on:

Home ground protection - reasserting American preeminence in the Western Hemisphere (Donroe Doctrine).

Defence - strategy of burden-sharing / burden-shifting, which encourages other nations to assume primary responsibility for their regions and contribute more to collective defence. The US also aims to revive its Defence Industrial Base, which involves reshoring of defence industrial supply chains.

Supply chain independence - securing access to critical supply chains and materials such that it is not dependent on outside powers for core components.

Energy - Restoring energy dominance in oil, gas, coal and nuclear and reshoring key energy components.

Crucial technologies - AI, biotech and quantum computing.

China

Meanwhile, China’s framework for its upcoming 15th five-year plan paints a picture of its pivot from growth at all costs to high-quality growth while strengthening its national security and domestic consumption.

Economic self-sufficiency - Combating sluggish domestic demand via boosting consumption, improving employment and incomes, fiscal spending.

Building up national security - Ensuring industrial chains are self-supporting and risk-resilient. Focus on food, energy and resources, key industrial and supply chains, transition to clean energy, building up strategic mineral reserves.

Technological sovereignty - Driving progress in integrated circuits, industrial machine tools, high-end equipment, software. Strengthening self-sufficiency in scientific and technological infrastructure.

Transition to clean energy - Developing wind, photovoltaic, hydro, and nuclear energy. Developing energy storage, constructing smart grids, microgrids.

Fostering industries of the future - AI, quantum, biomanufacturing, hydrogen and nuclear fusion power, brain-computer interfaces, robotics, 6G mobile.

While the USA and China may operate from different ideological foundations, they are essentially converging towards industrial policies that aggressively focus on the same critical chokepoints.

The realist’s guide to the galaxy

I am of the view that the era of frictionless digital scaling which was accelerated by Covid has reached a physical ceiling. Consequently, the most significant growth will now come from the gatekeepers of hard assets like specialised hardware, energy and critical commodities. This would be accentuated by inelastic demand from industrial policies.

“Software ate the world. Now hardware is fighting back with a vengeance.”

The sections that follow are my attempt to synthesise a messy set of narratives into a handful of coherent themes. I’m optimising for breadth here to illustrate the vastness of the opportunity set rather than trying to be exhaustive. Each theme (and many of the subthemes) could easily warrant a full article on its own.

Theme 1: Race for Sovereign Intelligence

If it were not clear yet, AI is no longer just a tech sector, but a strategic priority across multiple stakeholders of society.

To governments, it is the new “Space Race” for intelligence - see relevant article from mary from twitter.

“Winning the AI race will usher in a new golden age of human flourishing, economic competitiveness, and national security for the American people.”

“China aims to achieve secure and reliable supply of key core artificial intelligence (AI) technologies by 2027, with its industrial scale and empowerment level remaining among the world's forefront.”

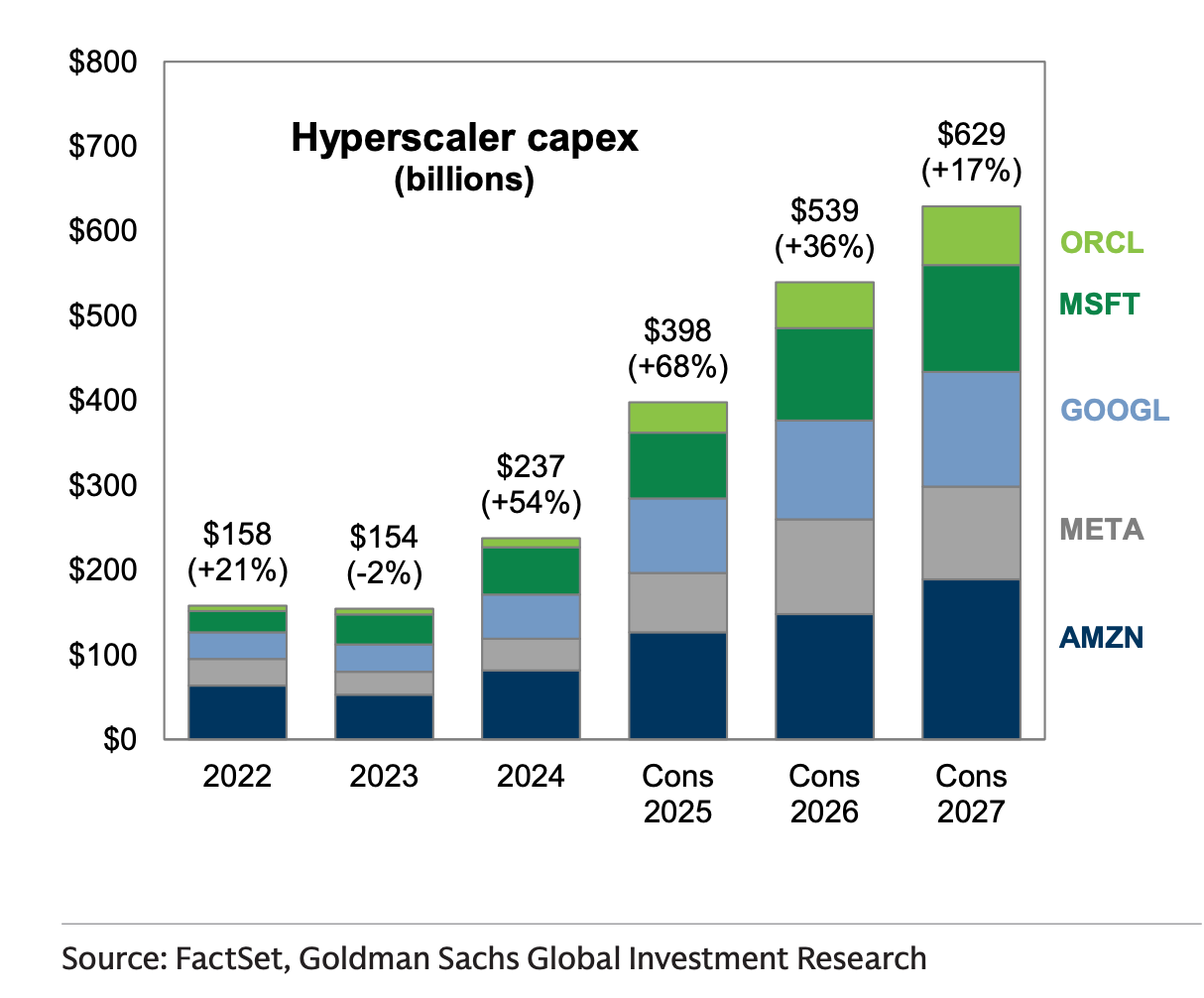

To corporates and startups, it is a quest for monopoly rents and enhanced productivity. This is best encapsulated by the amount of capital they are pouring into securing hardware and infrastructure for compute.

To capital providers, it represents a bid for the winning ticket in the next technological revolution. What started as a training-driven chip shortage seen in 2023 has cascaded into a secular growth cycle across the entire value chain.

This has translated to wealth creation opportunities throughout the hardware stack. As a simple illustration: Hyperscalers like Microsoft use Nvidia-designed Chips which are fabricated at TSMC. This requires memory components from SK Hynix, Micron and machinery from ASML and Applied Materials. Substrates from Ibiden and Unimicron are used in the packaging process, which are composed of glass cloth from Nittobo and copper.

The list goes on in both breadth and depth, and virtually every subsector has re-rated upwards. Yet, persistent shortages in intermediate components still exist, which suggests to me that there is still upside in this theme for the discerning investor.

There is much to unpack in this space, and I don’t pretend to have the full picture. But a few developments strike me as particularly interesting.

US sovereign AI build out - Intel becomes the de-facto national face of domestic HPC chips production, after the US Gov took a 9.9% stake. Acts as a hedge against geopolitical risks regarding TSMC, but faces idiosyncratic execution risks.

China’s push for self-sufficiency in AI - Guidance now restricts foreign AI chips in state-funded data centers, mechanically pulling demand toward domestic accelerators. Electricity subsidies reduce the operating costs of less energy-efficient domestic chips, making “good enough” hardware economically viable at scale. Additionally, recent Chinese AI IPOs have done well (Minimax, Zhipu, Biren). This supports the demand for domestic chips and might benefit BIDU (owns 59.45% of Kunlunxin, which has filed to go public).

Persistent demand for foundry tools - TSMC sets $52-56b capex budget for 2026 (+27% to +37% from 2025). This bodes well for foundry machinery spend on ASML, AMAT and other upstream inputs.

“Our customers continue to provide us with their positive outlook. In addition, our customers' customer, who are mainly the cloud service providers, are also providing strong signals and reaching out directly to request the capacity to support their business. Thus, our conviction in the multi-year AI megatrend remains strong, and we believe the demand for semiconductor will continue to be very fundamental.”

C.C. Wei - TSMC CEO, 4Q25 earnings call

Increased CPU demand due to agentic AI workflows - might benefit major CPU players like INTC and AMD.

“As agentic AI ramps up, millions of agents are accessing and doing productive work on compute resources at unprecedented speed with each agent interacting with data sources, tools, and other agents, generating constant streams of CPU-driven operations,”

Alexey Navolokin, General Manager, APAC, AMD

Ongoing shortages of key components - continued ASP and volume (dependent on capacity upgrades) momentum for memory, substrates and their upstream components.

“industry-wide supply for key components like DRAM, NAND and substrates has come under increasing pressure due to intense demand to support the rapid expansion of AI infrastructure.”

David Zinsner, Intel CFO, 4Q25 earnings call

Theme 2: Rearmament of the West

As the security fabric of Pax Americana is being re-woven, I believe that Western rearmament has become a structural necessity.

President Trump is calling for a ~50% hike of the US defence budget to $1.5T in 2027. This came after an executive order was issued to accelerate defence procurement. This includes identifying underperforming contractors and potentially restricting dividends and stock buybacks on such firms to prioritise delivery and capacity.

While the headline seems knee-jerk bearish due to the restriction of shareholder-friendly practices, it paints a longer-term sanguine picture for the orderbooks of US defence contractors.

“Every firm across our economy has a right to profit from prudent investment and hard work, but the American defense industrial base also has the responsibility to ensure that America’s warfighters have the best possible equipment and weapons. These two objectives are not mutually exclusive.”

Executive Order: Prioritizing The Warfighter In Defense Contracting

Meanwhile, the US is adopting a more transactional “America First” stance which deprioritises foreign military presence in regions of little national interest to them and encourages allies to take primary responsibility for its own defence.

“Our elites badly miscalculated America’s willingness to shoulder forever global burdens to which the American people saw no connection to the national interest.”

This posture is forcing Europe into a reckoning moment. It must now reconcile its underinvestment in defence with the emergence of “an arc of instability” around its periphery.

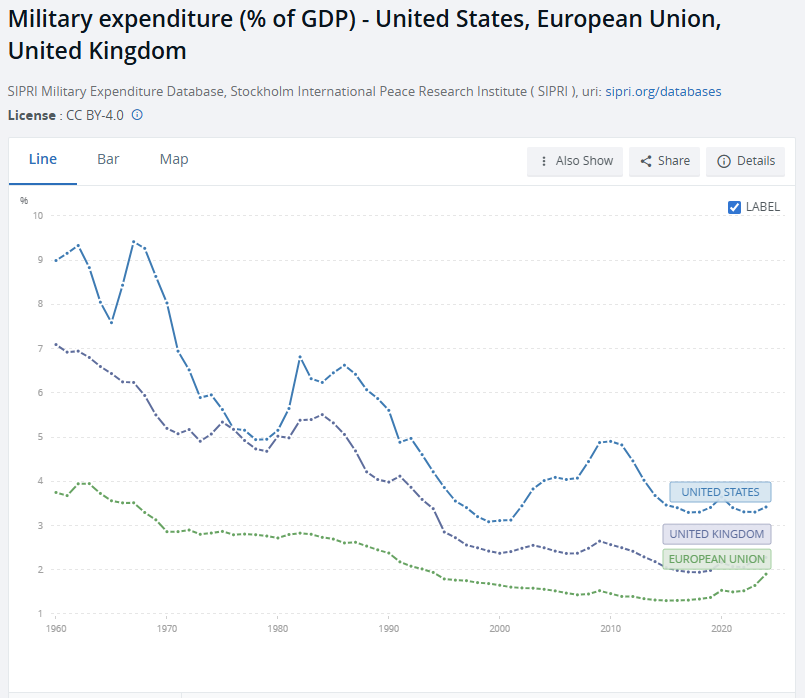

The natural resolution to this dichotomy would be accelerated defence spending in Europe in a bid to restore self-reliance in its own defence industrial base, especially in light of its dependence on the US for arms. This is now anchored by NATO’s pledge to raise combined defence spending to 5% of GDP by 2035. For most EU NATO members, this means a decade-long ramp from the ~2% range, and is supportive of sustained order growth for European primes over the medium to long term.

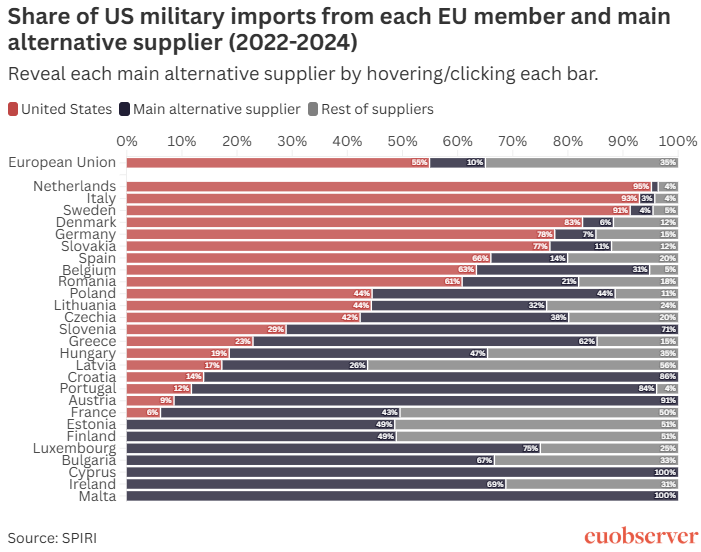

That said, it would be challenging for Europe to immediately decouple their defence supply chains from the US, which signals that the region would continue to act as a strong secondary customer base for US primes.

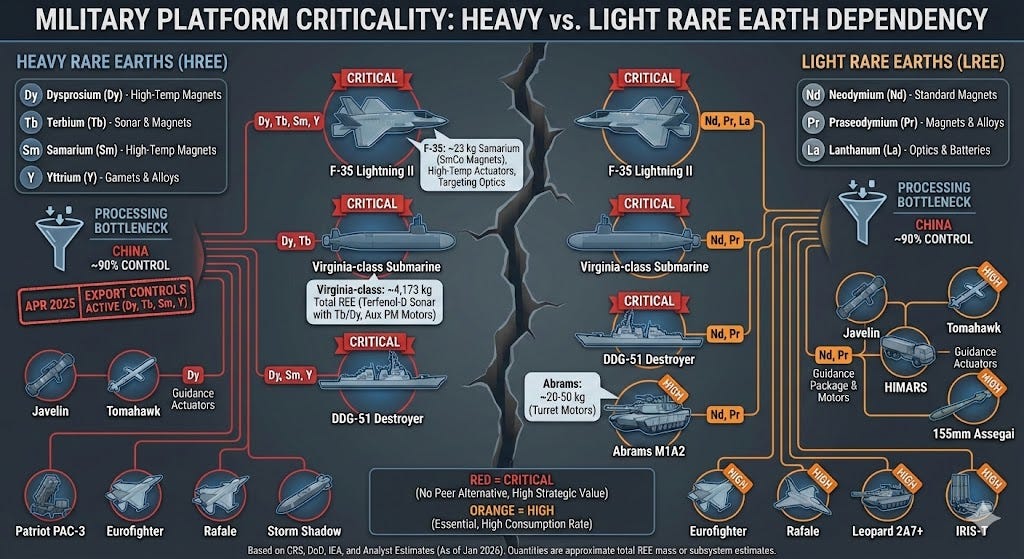

Moreover, the simultaneous rearmament of the US and Europe further strengthens the case for Western supply chain resilience for rare earths. Many precision-guided systems in the West rely on rare earth magnets which are mostly processed by China. This critical dependency is likely to reinforce the need for the West to work more with “friendly” players with mining and refining capabilities.

Finally, defence is also breaking new technological frontiers with the increased adoption of AI (eg. in the case of autonomous weapon systems) and space-based infrastructure (eg. tracking sensors and interceptors). I believe that this convergence of emergent technologies and rising defence spending introduces an additional valuation premium for relevant defence equities, fueled by the ongoing AI hype cycle and speculation around a potential SpaceX IPO.

Theme 3: Energy Resilience

Ultimately, global reindustrialisation efforts converge on a single bottleneck - energy. The issue here is not so much a lack of energy but a crisis of grid infrastructure and power delivery.

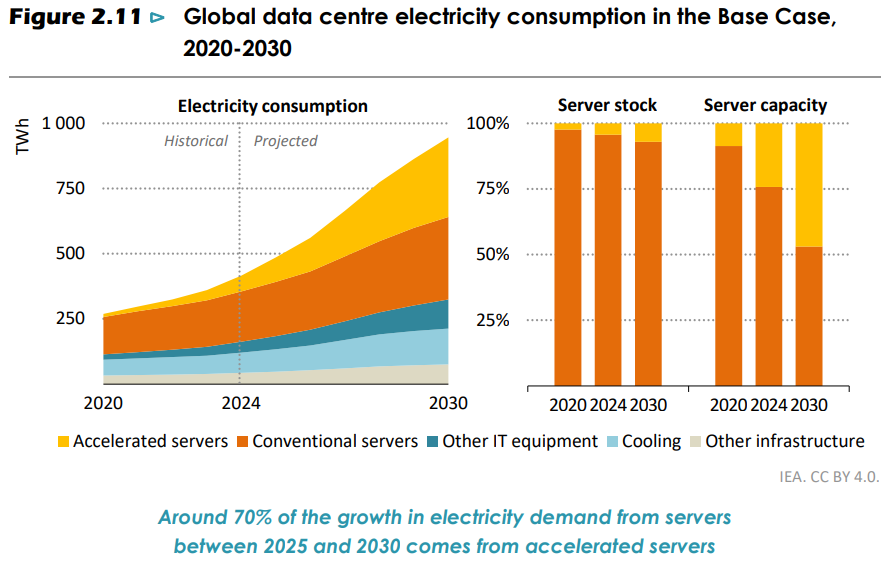

AI data centres represent one of the fastest growing segments of energy consumption - their electricity demand is expected to double in 5 years.

But data centers can be built faster than the grid and generation infrastructure needed to serve them, and their geographic clustering creates local capacity crunches. For instance, there are 6 states in the US where data centres consume > 10% of local electricity supply (Virginia takes pole position at 25%). This benefits companies that ease bottlenecks in the power transmission value chain like transformers, cables and grid construction. It would also provide tailwinds for companies that already own energised land to lease to hyperscalers.

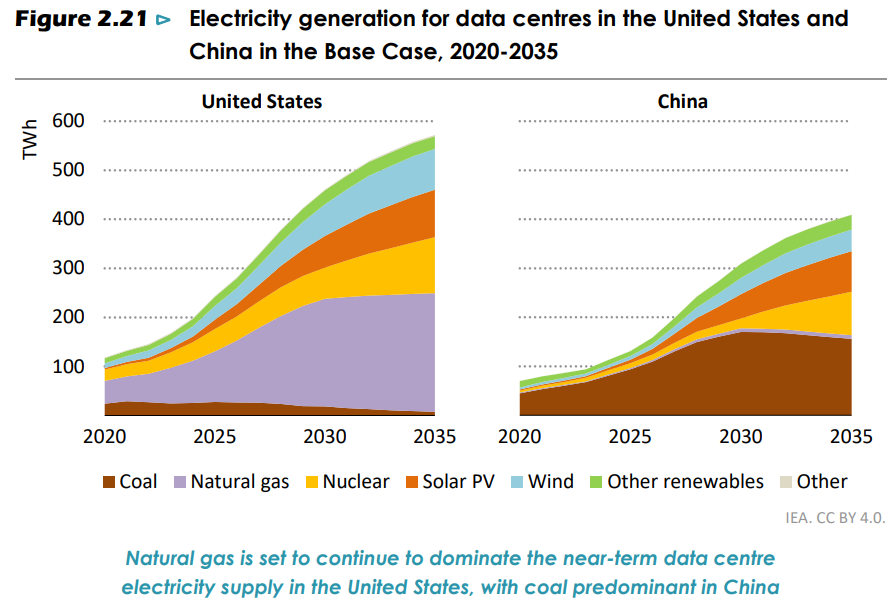

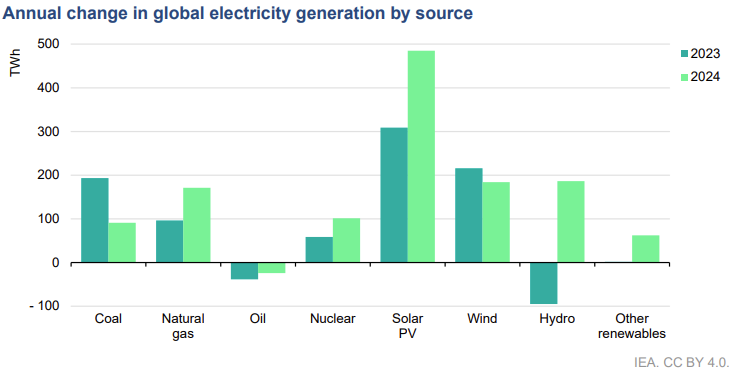

To further tackle this problem, it is estimated that half of the global growth in data centre electricity demand will be met by renewables by 2035.

Solar is the fastest growing energy source, due to its quick deployment times. When combined with battery storage tech, the resulting configuration provides constant supply to support the uptime requirements of data centres while staying cost competitive.

This is a boon for the solar and battery storage value chain, especially so for non-Chinese manufacturers due to the reduction / cancellation of export tax rebates on Chinese PV and battery products. Moreover, rising global usage of solar and battery tech is likely to continue to drive demand for commodity inputs like silver and lithium, where both of which are currently facing projected supply deficits.

Lastly, nuclear is starting to play a vital role in the energy mix beyond 2030. US-based big tech firms have already committed to > 10GW of nuclear energy to power their data centres via a mix of new builds, restarts and use of small modular reactors (SMR). This trend is largely mirrored in China and elsewhere like Europe and Japan as countries race to secure energy supply for their long-term requirements.

Nuclear power sits at the intersection of civilian energy use cases and military strategy, making it especially imperative for national security. The critical chokepoint for nuclear fuel globally is currently in enrichment, with Russia and China controlling > 50% of global LEU enrichment capacity. Russia is also the only nation to commercially produce HALEU, which is crucial for SMRs. Resultantly, the US is aiming to wean itself off Russian supply and build up domestic HALEU refining capacity.

TLDR

If you have made it this far, I thank you for having survived my verbose attempt to make sense of what’s been happening in the world. Here’s a summary of what’s been discussed:

National security requirements are converging with physical manufacturing limitations, leading to reindustrialisation and rewiring of global supply chains.

The increasing urgency of policy actions and resultant capital flows are being reflected in markets, compressing cycles.

Sovereign AI - Multiple stakeholders are vested in the progress of AI. This enormous end demand has led to cascading manufacturing bottlenecks across the entire value chain, which provides opportunities for the discerning investor.

Rearmament of the West - Under Trump, the US is aiming to spend more to strengthen its defence industrial base and push allies to do the same. Their renewed focus on fortifying their near-abroad has led to Europe having no choice but to pick up the slack to bolster defence around its periphery. This creates a multi-year tailwind for the orderbooks of US and European defence contractors.

Energy Resilience - Energy is the foundation of reindustrialisation but key issues remain in US grid modernisation and meeting localised energy requirements. To meet energy demand, solar + battery storage tech are the fastest growing stopgap solution in the renewables space. Additionally, nuclear is set to play a vital role in the energy mix in the longer-term, but chokepoints still remain in enrichment. This bodes well for companies that can ramp capacity to meet demand, and benefits crucial input commodities.

Positioning in disequilibrium

Indeed, the world seems like it is in disequilibrium. Through my lens, the grind towards a new equilibrium is being shaped by industrial policy and re-wiring of supply chains to solve key physical bottlenecks that serve various national interests.

My current personal exposure to these themes is composed of a mix of core factor exposures, sprinkled with a handful of single names for additional juice. This reflects my personal style preference for leveraging beta, which balances upside with idiosyncratic downside risk in single names.

Race for Sovereign Intelligence

SMH - Catch-all basket for global AI hardware stack.

EWY - Convenient workaround for exposure to Korean-listed memory players, SK Hynix and Samsung. ~45% of EWY is composed of these 2 companies.

UMS Integration (SGX:558) - Singapore-listed OEM for semiconductor equipment. Bulk of revenue derived from Applied Materials and Lam Research, both of which benefit from accelerating foundry capex.

BIDU - Exposure to Kunlunxin amidst rising demand for domestic chips and Chinese IPO boom.

Seikoh Giken (TSE:6834) - Exposure to rising fiber-optic density in data centres. Thesis well-covered by STF and Asymmetric Opportunities.

Rearmament of the West

SHLD - Catch-all basket for key defence primes.

Energy Resilience

LIT - Catch-all basket for lithium and battery tech.

URNM - Catch-all basket for uranium ore + miners.

IREN - Exposure to their 2.75GW of pre-secured energised land in Texas which provides hyperscalers with a shortcut past current > 5 year grid interconnection queues.

Death of software (?) and other open questions

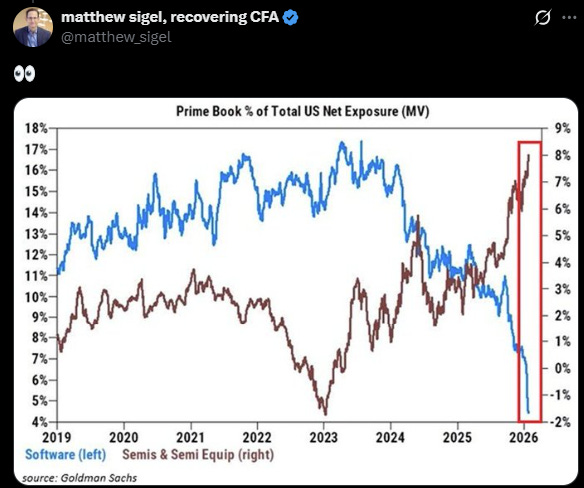

While I have conviction in these themes, I am acutely aware that some of the above names have already benefited from glorious run-ups and I endeavour to be nimble with my positioning if momentum stalls.

Moreover, as we progress through the cycle, my exposure will likely shift upstream of the value chain in search for underlooked beneficiaries. I am also looking to shore up my understanding of the Chinese AI and energy supply chain to ride the wave of domestic demand and grid modernisation efforts.

Another developing trend I am keeping an eye on is the pendulum swing between hardware and software. For now, momentum is with hardware (rightly so in my view), which has contributed to the “AI Armageddon” narrative for enterprise SaaS. But when positioning and multiples in software reach extreme levels, I think it would be a profitable venture for me to separate the wheat from the chaff.

All of this to say, it is hard to squeeze too many topics in one article without readers losing their attention span, and markets are dynamic which emphasises the need to be nimble. So please subscribe to follow me on my quest to find more chokepoints.

Thank you for your attention to this matter!

-Bryan @ Snowball Research

Important Disclosure

This publication reflects my personal opinions and is provided for general information and education only. It is not financial advice, a research report, a recommendation, or a solicitation to buy or sell any security, derivative, fund, or digital asset, and it does not take into account your objectives, financial situation, or needs. I am not licensed by the Monetary Authority of Singapore to provide financial advisory services under the Financial Advisers Act.

Investing involves risk, including the possible loss of principal. Past performance is not indicative of future results. Digital assets can be extremely volatile and may offer limited regulatory recourse; you could lose all the money you invest. Information herein is believed accurate at publication but may be incomplete or change without notice; I make no warranty and have no obligation to update this content.

I may hold positions in assets mentioned, and may change those holdings at any time without notice. Nothing here should be relied upon as a basis for investment decisions; please do your own research and consult a licensed financial adviser before acting.

Strong synthesis of how industrial policy is reshaping capital flows. The chokepoint framework is particularyl useful because it cuts through the noise of macro headlines to identify actual scarcity. Noticed the same pattern in semicondutor equipment where lead times for critical toolslike EUV are still stretching despite all the capacity announcements. The US/China convergence on similar priorities while trying to decouple supply chains creates some really counterintuitiv dynamics too - makes timing these themes tricky even when the direction seems clear.