Maximising Sleep-Adjusted Returns

Navigating markets in the age of hyper-acceleration

Crypto, AI, Snowballing

It’s been a week since wrapping up my time as Head of Research at DeFiance Capital. During my 4 years here, I’ve had the privilege of working alongside the brightest of minds and boldest of capital allocators in a frontier market that has been both challenging and rewarding to navigate.

I’m headed back to school to further my studies in the field of AI for both personal and professional development. Regardless of where AI is on the hype cycle now, it seems inevitable to me that AI will be deeply embedded in most industries in the years to come. Being early in my career, I believe I owe it to myself to be fully immersed in the trend and figure out how to ride it.

Alas, I am a creature of the markets (and not nearly rich enough to ride into the sunset). Snowball Research will be where I jot down notes on markets, as well as on other trends, innovations and experiments that pique my interest.

Why Snowball? The snowball effect is a process that starts small but builds upon itself, just like how a snowball grows bigger as it rolls down a mountain. It embodies my goals of compounding knowledge, skills, heuristics, relationships and hopefully wealth over time.

The path forward - nothing stops this train!

Predicting market outcomes is a multivariate problem, so it is useful to find a guiding light to illuminate the path ahead. For me, that light is the trajectory of US economic policy, which I believe to be stimulative for the next 1-2 years. This gives me a sufficient runway of reasonable certainty for how I should be traversing the path ahead.

Fiscal Policy

The U.S. economy, however, is deeply tied to the stock market, creating a strong incentive for policymakers to support equities rather than risk a drop in revenues from falling asset prices.

The result is a fragile cycle: fiscal spending drives asset prices higher, rising asset prices increase tax receipts, and those receipts sustain further spending.

Lyn Alden / Sam Callahan - Full Steam Ahead: All Aboard Fiscal Dominance

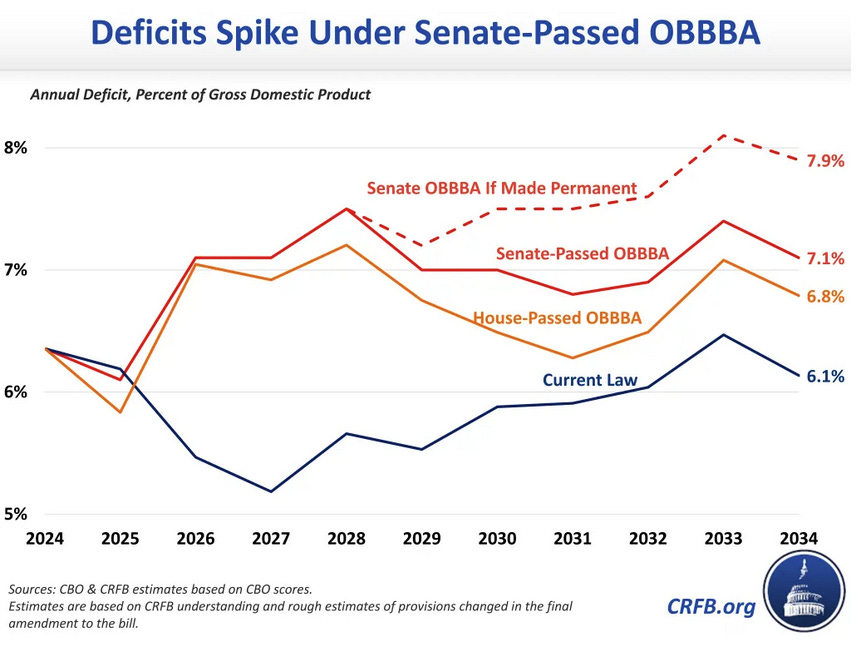

With the passage of the OBBBA, it seems like the current administration is abandoning its initial goal to cut deficits, instead choosing to run the economy hot in an attempt to outgrow the debt. The Senate version of the OBBBA would be the largest spending bill in recent history. Notably, the fiscal deficit as a % of GDP would see the largest rate of change from 2025 > 2026.

Monetary Policy

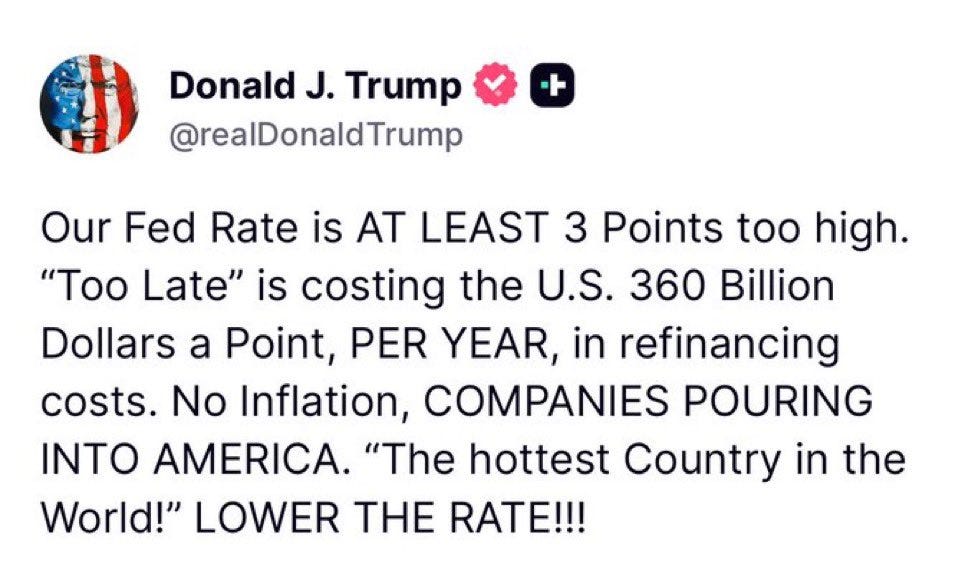

US interest rates are on track to resume their downward trajectory in 2H25, conditional on the data. Furthermore, the views of the current Fed members seem to hold little weight in the grander scheme of rate trajectory at this point, with Trump repeatedly calling for the resignation of Fed chair Powell for holding rates too high, as well as reports of the administration appointing a shadow Fed chair who could telegraph lower rates to the market.

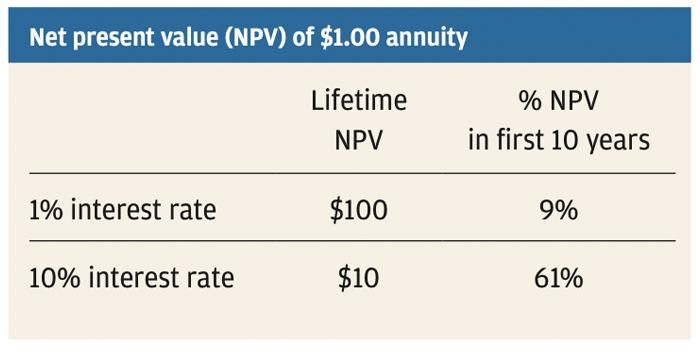

When you analyze a stock, you look at many factors: earnings, cash flow, competition, margins, scenarios, consumer preferences, new technologies and so on. But the math above is immovable and affects all.

Jamie Dimon - JPM Chairman & CEO Letter to Shareholders 2022

The takeaways for me here are simple:

Fiscal policy should get looser from 2026 = asset price appreciation would likely follow suit

Monetary policy should get looser from 2026 = asset price appreciation would likely follow suit

Portfolio expression principles: Maximising sleep-adjusted returns

Having established a longer-term bullish bias, I now have to figure out the best way to express this view. Crucially, I aim to do so while avoiding losing sleep over these investments (A mistake I have committed multiple times throughout my investment journey!). Of course, I could simply go all-in on relatively safe index funds to express this view. But where would be the fun in that? After all, don’t we all think we can beat the market?

To me, maximising sleep-adjusted returns does not just mean filtering out volatility (which might hurt returns by clipping both right and left tails). Rather, it is trying to achieve the following:

Still playing for high upside / outperformance

Acknowledging the Pareto principle and finding the vital few factors that matter

Refining asset selection to reduce risk of mental anguish - eg. over-trading, obsessive tape-watching, predatory price action, gap downs, round-tripping etc

Knowing when to place ideas in the “too hard” pile - I can’t possibly have a view on everything

My theory is that most investment models maximize for risk-adjusted returns, but in the real world every investor wants to maximize for sleeping well at night and being proud of themselves in a complicated world.

Morgan Housel - Rational vs Reasonable

Redefining the opportunity set

If you’ve made it this far into the article, you know my why and how. This section covers my where - defining the investment universe where I aim to play in.

I compete against what I would call the opportunity set. And if there was a great opportunity set that year and I missed it, I'm disappointed in myself. Like if I'm up 20% and I think I should have been up 50%, I'm disappointed myself. If the opportunity set was basically to be up 10 or 15 and I'm up 20, I'm thrilled.

Stanley Druckenmiller - In Good Company Podcast | Norges Bank Investment Management

The bifurcation of crypto markets

BTC and ETH

If BTC were the sole representation of the crypto markets, it could be said that crypto has been in a solid bull trend for the past 3 years since the FTX crash - (>600% from trough to peak, and almost 2x its previous high of ~$69k in 2021). This was aided by strong ETF inflows (>$50b cumulative net flow since Jan 2024), a consistent bid from MSTR ($68b held on balance sheet) and other BTC DATs, as well as regulatory tailwinds (eg. US Strategic Bitcoin Reserve).

After being stuck in a 3-year range, ETH finally broke its 2021 high recently, also driven by ETF flows (>$13b cumulative net flow since Aug 2024),a slew of ETH DATs (>$14b held on balance sheet), as well as institutional adoption of stablecoins.

Alts (OTHERS)

While BTC and ETH have surpassed their previous cycle highs, the same cannot be said about the vast majority of crypto assets (I know XRP did as well - I get it, but that’s besides the point).

Investing in alts in 2025 is vastly different from the past.

The 2020 / 2021 alts bull run was driven by a wave of rapid product innovation + massively stimulative environment which fed the reflexive loops of various tokens.

During the 2023 / 2024 alts bull run, the liquid venture approach to investing in alts worked out well as everything sold off indiscriminately during the FTX washout. Tokens of quality projects sold off despite having strong treasuries and motivated teams and were re-priced subsequently.

In 2025, the sheer number of tokens has ballooned, coupled with investor unlocks creating a supply overhang to the tune of >$4b a month. Moreover, on the demand side, it is also clear that there is less of a wealth effect that trickles down to alts when BTC and ETH appreciate in price.

Consequently, the universe of investable tokens has shrunk. Viewed from the lens of an institutional investor, there seems to be common universe of < 30 tokens (excluding majors) that form the mainstay of portfolio construction. These tend to be projects that have dominated a niche and mastered both value creation and accrual. Hyperliquid is the poster boy for this group.

Most other tokens have lacklustre performance, with prices being jolted to life every few months by ephemeral narratives. Now this is not meant to be a doompost but a sober assessment of the state of the market - I believe the market will sort itself out, although it may take some time. Eventually, the demand / supply dynamic will resolve through a combination of 1) investor unlocks clearing out over time, 2) maturing of business models resulting in sustainable value accrual and subsequent valuation re-rating, 3) rebalancing of institutional capital from primary to secondary markets due to shifting risk-reward, 4) creation of exogenous token sinks in the form of ETFs and DATs.

Equities and other expressions of global trends

Outside of crypto, there are a plethora of secular trends that I could potentially take the effort to study, research and invest in. Recent case studies that come to mind are:

Consumer obsession with Labubu dolls > Popmart

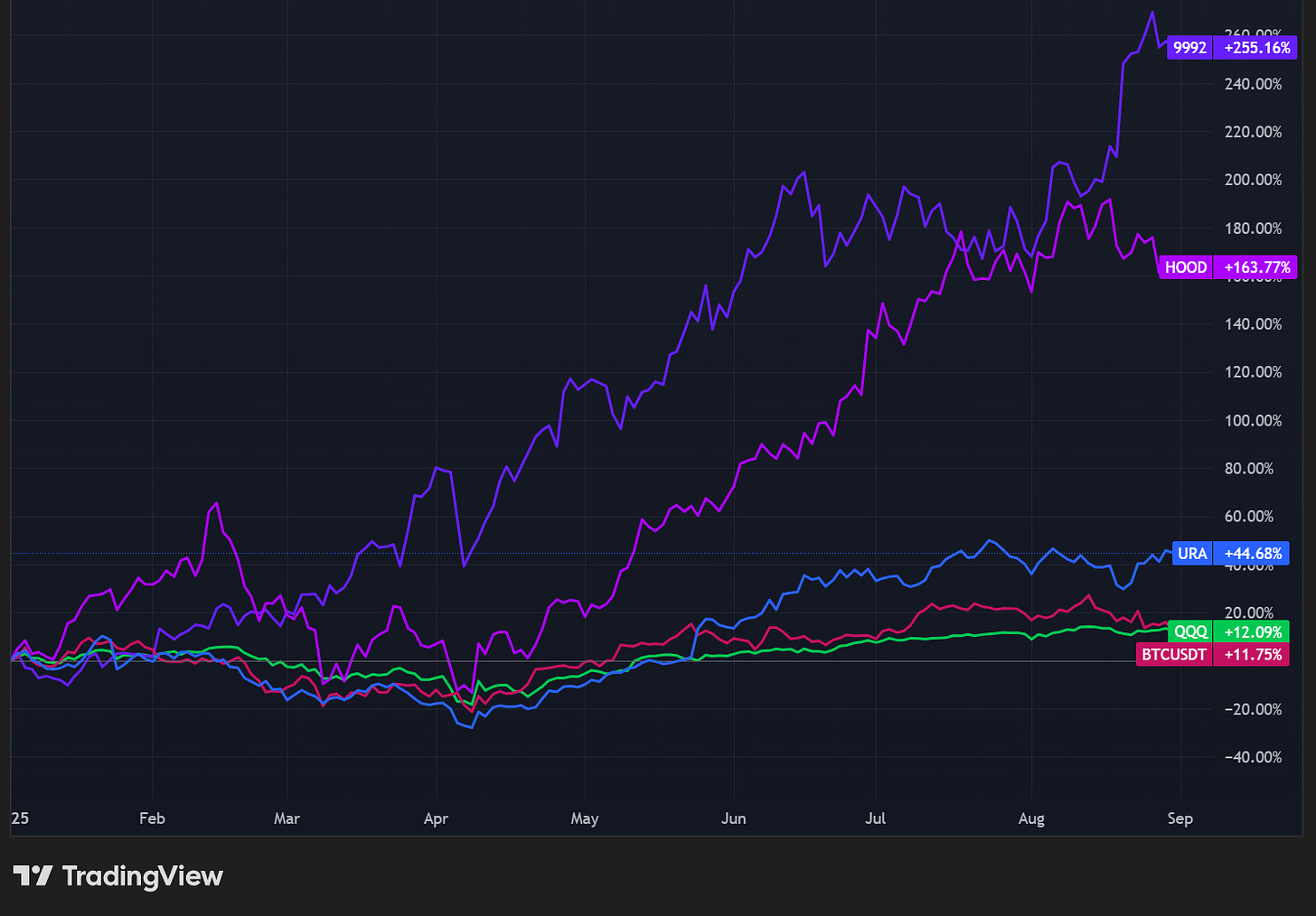

Rise of speculative retail risk-taking in the form of retail options and crypto trading > Robinhood

Data center buildout causing power crunch + undersupply of Uranium ore post-Fukushima > Uranium / miners

H/t to my buddies at Hindsight Capital and SurvivorshipBias Partners for pointing out that these have outperformed both BTC and QQQ ytd.

My mate at Cherrypicking Ventures takes it to the extreme. He examined the best crypto trades in recent memory that one could execute 1) in reasonable size and 2) with reasonable accessibility (Unfortunately this excludes all the heroes who did a 100x on Launchcoin). He then compared it to the most well known TradFi trade in recent memory.

BTC from the FTX lows to most recent ATH (>7x)

HYPE from the TGE closing price of $6.50 to most recent ATH (>6x)

XRP from the US election date to most recent ATH (~6x)

NVDA from ChatGPT Plus launch date (1 Feb 2023) to most recent ATH (>8x)

Jokes aside, my takeaway was clean: NVDA, a mega cap with deep liquidity and universal access delivered a higher return than the best scalable crypto trades with arguably less risk. Therefore, the Nvidias, Popmarts, Robinhoods and Uraniums belong in my aspirational opportunity set. Missing such well-telegraphed, highly liquid secular winners is more inexcusable to me than missing a random 2-3x short squeeze on a small cap token.

Casting the line

I now know why I am fishing, how to fish, and where to cast - time to land some worthy catches. I aim to build a list of assets that can help me play offence, and will share them in subsequent posts.

Having paid a hefty amount of tuition fees to Mr Market for his wise lessons, these are a list of general positive characteristics that I aim to look for in these assets:

Beneficiary of fiscal spending / falling rate environment

Beneficiary of structural trends / narratives

Rapid topline growth, industry growth

Right to win in its industry

“Heads I win, tails I win less” outcomes

Inflection points in fundamentals / positioning

Sufficient attention

What happens after 1-2 years? Will it all be over? My current answer is don’t know! That’s in my “too hard” pile. My view will adjust accordingly with policy trajectory and asset prices. What I aim to avoid is being caught offside in a 2022-esque drawdown where even secular winners offered poor sleep-adjusted returns (eg. META 75% peak to trough drawdown).

TLDR

Why I remain bullish over the medium term: Policy trajectory indicates favourable conditions for risk.

How I wish to express this view: Play for upside, minimise mental anguish, maximise sleep-adjusted return.

Where I plan to play: Unconstrained across equities (structural trends) and crypto (selective list of majors, alts, occasional narratives).

What I am looking for: Secular winners

Thank you for your attention to this matter!

-Bryan @ Snowball Research

Important Disclosure

This publication reflects my personal opinions and is provided for general information and education only. It is not financial advice, a research report, a recommendation, or a solicitation to buy or sell any security, derivative, fund, or digital asset, and it does not take into account your objectives, financial situation, or needs. I am not licensed by the Monetary Authority of Singapore to provide financial advisory services under the Financial Advisers Act.

Investing involves risk, including the possible loss of principal. Past performance is not indicative of future results. Digital assets can be extremely volatile and may offer limited regulatory recourse; you could lose all the money you invest. Information herein is believed accurate at publication but may be incomplete or change without notice; I make no warranty and have no obligation to update this content.

I may hold positions in assets mentioned, and may change those holdings at any time without notice. Nothing here should be relied upon as a basis for investment decisions; please do your own research and consult a licensed financial adviser before acting.